Democrats Push Tax Cuts For The Wealthy

The Majority Of Benefits From The Changes To Tax Law Democrats Want Would Go To ‘The Top 1 Percent Of Households’

SENATE MAJORITY LEADER MITCH McCONNELL (R-KY): “[R]ather than acknowledge that the sky hasn’t fallen, our Democratic friends still want to undermine tax reform. And listen to where they’ve elected to start … Democrats’ first target is changing the tax code so that working families across the country have to subsidize wealthy people in states like New York, New Jersey, and California…. Republicans didn’t think it was fair that middle-class working families in the states the Obama economy left behind had to subsidize the tax bills of rich people in high-tax states, without limit. We didn’t eliminate the state and local tax deduction; we just capped it for high earners. That cap is what Democrats want to undermine. Their resolution would help high-tax states — typically governed by Democrats — create workarounds for their high-earners…. It’s bad enough that my Democratic colleagues want to unwind tax reform. But it’s downright comical that their top priority is helping wealthy people in blue states find loopholes to pay even less.” (Sen. McConnell, Floor Remarks, 10/23/2019)

“Senate Democrats plan to force a vote on reviving programs in states like New York and New Jersey designed to help residents circumvent the $10,000 limit on deductions for state and local taxes.” (“Senate Democrats to Force Vote to Reduce SALT Cap Sting,” Bloomberg News, 10/11/2019)

- “The tax law that President Trump signed in 2017 imposes a $10,000 cap on the SALT deduction…. In an effort to circumvent the SALT deduction cap, some blue states passed legislation that was aimed at allowing residents to be able to convert state and local taxes into charitable contributions. But the Treasury Department and IRS issued final rules in June aimed at preventing these types of arrangements from working as ways to circumvent the SALT deduction cap, upsetting many Democratic lawmakers. [Senate Minority Leader Chuck] Schumer [D-NY] introduced a resolution in July to overturn the rules …” (“Senate Democrats Aim To Repeal Rules Blocking Trump Tax Law Workarounds,” The Hill, 10/10/2019)

Joint Committee On Taxation: 94% Of The Benefits Of Repealing The Cap On State And Local Tax Deductions Would Go To Taxpayers Making Over $200,000

SEN. McCONNELL: “Let’s be clear about what would happen if Democrats got their real objective and repealed the SALT cap altogether.” (Sen. McConnell, Floor Remarks, 10/23/2019)

JOINT COMMITTEE ON TAXATION: “[A] proposal to repeal the $10,000 limitation on the deduction for State and local taxes beginning in 2019 … is estimated to result in a decrease in tax liability for 13.1 million taxpayers, 94 percent of which have $100,000 or more of economic income. Additionally, approximately 99 percent of the decrease in tax liability accrues to taxpayers with $100,000 or more of economic income.” (“Background On The Itemized Deduction For State And Local Taxes,” Joint Committee on Taxation, JCX-35-19, 6/24/2019, p. 14)

- Further, 94 percent of the benefit from repeal of the deduction for state and local taxes would flow to taxpayers with incomes over $200,000 per year. And only 6 percent of the benefit from repeal would go to taxpayers with incomes under $200,000. (“Background On The Itemized Deduction For State And Local Taxes,” Joint Committee on Taxation, JCX-35-19, 6/24/2019, p. 14)

- And 52 percent of the benefit from repeal of the deduction would go to those with incomes over $1 million. (“Background On The Itemized Deduction For State And Local Taxes,” Joint Committee on Taxation, JCX-35-19, 6/24/2019, p. 14)

According to Joint Committee on Taxation estimates, repealing the SALT cap would result in large tax cuts for millionaires and almost no benefit for middle class taxpayers making between $50,000 and $100,000 per year. (“Background On The Itemized Deduction For State And Local Taxes,” Joint Committee on Taxation, JCX-35-19, 6/24/2019, p. 14; “Overview Of The Federal Tax System As In Effect For 2019,” Joint Committee on Taxation, JCX-9-19, 3/20/2019, p. 34)

- An estimated reduction in tax liability of $40.4 billion from repeal of the cap would mean that taxpayers with $1,000,000 or more in income would see a tax cut of $60,000 while taxpayers with between $50,000 and $100,000 in income would see a tax cut of less than $10. (“Background On The Itemized Deduction For State And Local Taxes,” Joint Committee on Taxation, JCX-35-19, 6/24/2019, p. 14; “Overview Of The Federal Tax System As In Effect For 2019,” Joint Committee on Taxation, JCX-9-19, 3/20/2019, p. 34)

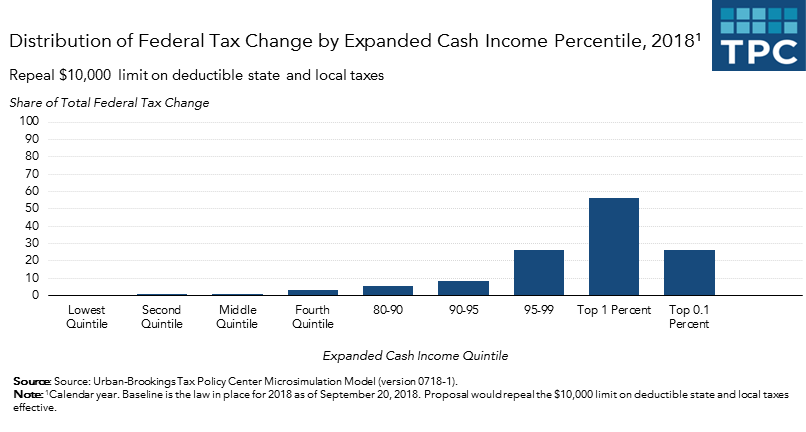

Tax Policy Center: ‘About 96 Percent Of The Benefits’ Of Repealing The Cap On State And Local Tax Deductions ‘Would Go To The Top 20 Percent Of Taxpayers’

TAX POLICY CENTER: “Congressional Democrats have introduced several proposals to repeal the new cap on state and local deductions. About 96 percent of the benefits for doing so would go to the top 20 percent of taxpayers, according to the Tax Policy Center. Other analyses have found similar distributional impacts of the cap.” (“Democrats Said A GOP Tax Law Provision Would Devastate Blue States. That’s Not Happening.,” The Washington Post, 5/01/2019)

- “The top 1 percent of households, those making $755,000 or more, would receive more than 56 percent of the tax cut.” (Howard Gleckman, “High-Income Households Would Benefit Most From Repeal of the SALT Deduction Cap,” TaxVox: Individual Taxes, Tax Policy Center, 9/24/2018)

###

SENATE REPUBLICAN COMMUNICATIONS CENTER

Related Issues: Middle Class, Tax Reform, Taxes, Senate Democrats

Next Previous