‘Brutal’ CPI Report Shows American Families Suffering Under Biden’s Historic Inflation Surge

Despite President Biden Confidently Predicting ‘It’s The Peak Of The Crisis’ And That Prices Would Start Going Down Exactly Six Months Ago, Inflation In May ‘Hit A Fresh 40-Year High,’ Bringing ‘Into Sharp Relief Just How Inescapable Inflation Has Become For Millions Of American Households’ As Price Increases For Food, Energy, And Housing Make Families Struggle To Afford The Most Basic Expenses

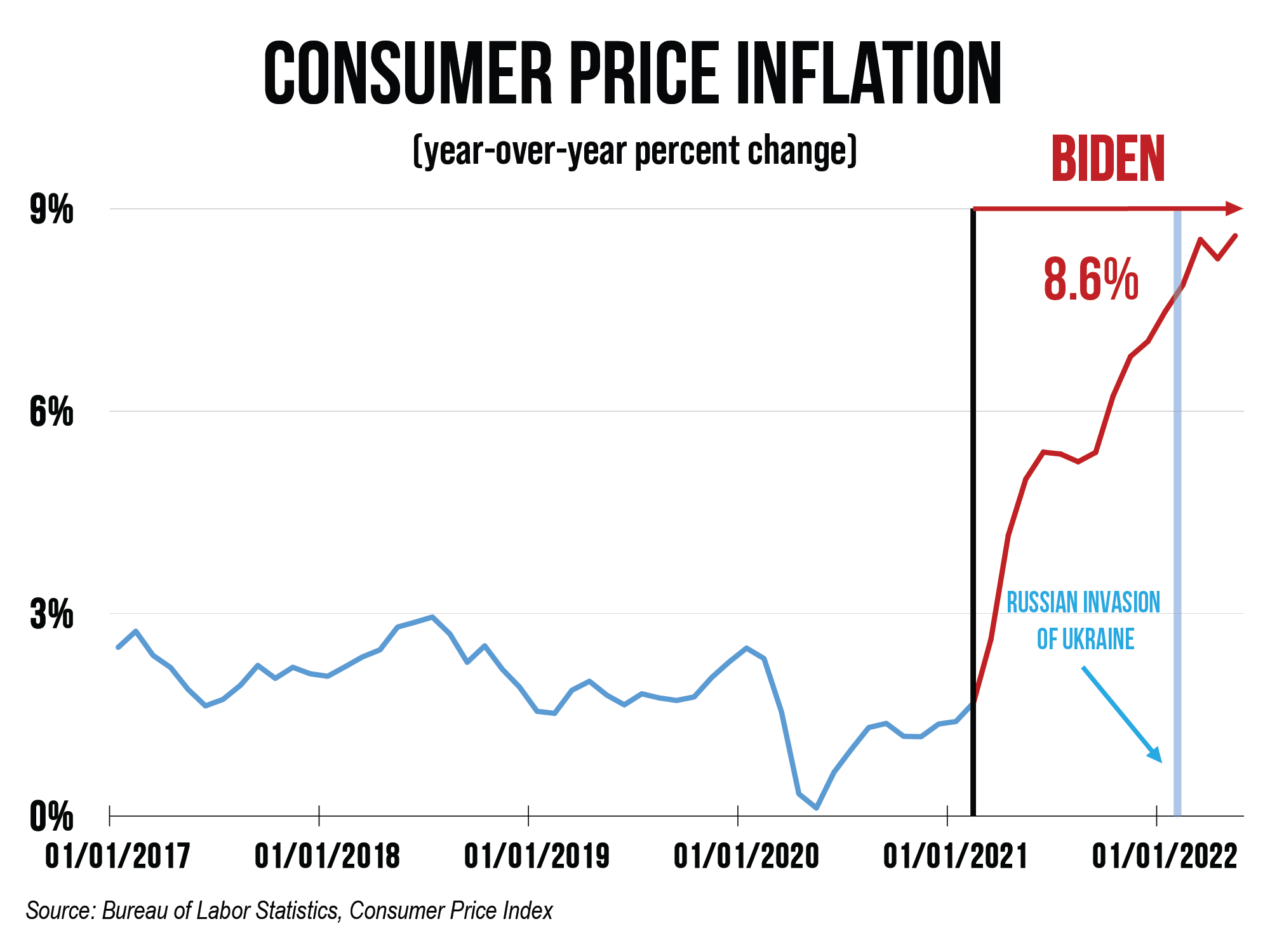

Inflation In May ‘Unexpectedly’ Increased 8.6% Year-On-Year, ‘A Fresh 40-Year High’

“US inflation hit a fresh 40-year high in May, unexpectedly accelerating in a broad advance that pressures the Federal Reserve to extend an aggressive series of interest-rate hikes and adds to political problems for the White House and Democrats. The consumer price index increased 8.6% from a year earlier, Labor Department data showed Friday. The widely followed inflation gauge rose 1% from a month earlier, topping all estimates. Shelter, food and gas were the largest contributors. The so-called core CPI, which strips out the more volatile food and energy components, rose 0.6% from the prior month and 6% from a year ago, also above forecasts.” (“US Inflation Unexpectedly Accelerates to 40-Year High of 8.6%,” Bloomberg, 6/10/2022)

‘The Brutal Report Surprised Economists And Brings Into Sharp Relief Just How Inescapable Inflation Has Become For Millions Of American Households’

“The brutal report surprised economists and brings into sharp relief just how inescapable inflation has become for millions of American households. Some of the biggest run-ups were in energy, food, and housing, core parts of nearly every Americans’ budget. ‘Whatever Washington has done to try to fix the cost of living crisis in America, it isn’t working,’ Chris Rupkey, chief economist at the research firm FWDBONDS LLC, said in an analyst note. ‘This isn’t just Russia and Ukraine anymore.’” (“Inflation Hit New Peak May, Amid High Gas Prices,” The Washington Post, 6/10/2022)

“May’s increase was driven by sharp rises in the prices for energy, which rose 34.6% from a year earlier, and groceries, which jumped 11.9% on the year. Prices for used cars and trucks rose 1.8% in May from April, reversing three months of declines. Shelter costs, an indicator of broad inflation pressures, accelerated on a monthly basis in May and were up 5.5% compared with a year ago.” (“U.S. Inflation Hit 8.6% in May,” The Wall Street Journal, 6/10/2022)

- “Gas and energy prices were not the sole driver of May’s bleak inflation report. Categories for shelter, airfare, used cars and trucks and new vehicles were among the largest contributors. The cost of medical care, household furnishings and clothing also went up. The food index increased 10.1 percent for the 12-months ending May, the first double-digit increase since 1981. Measures for dairy and related products rose 2.9 percent in May compared to April, its largest monthly increase since July 2007. Meats, poultry, fish, and eggs rose 1.1 percent over the month, with the index for eggs rising 5.0 percent. The index for airline fares continued to rise, increasing 12.6 percent in May after rising 18.6 percent the prior month. The index for used cars and trucks rose 1.8 percent in May after declining in each of the 3 prior months.” (“Inflation Hit New Peak May, Amid High Gas Prices,” The Washington Post, 6/10/2022)

Exactly 6 Months Ago, President Biden Said We Were At The ‘Peak Of The [Inflation] Crisis’ But Inflation Surged Ahead At 7% Or More Every Month Since

PRESIDENT JOE BIDEN: “It’s the peak of the crisis, and I think you’ll see it change sooner than — quicker than — more rapidly than it will take than most people think. Every other aspect of the economy is racing ahead. It’s doing incredibly well. We’ve never had this kind of growth in 60 years. But inflation is affecting people’s lives. … I think you’re going to see — you’ve already begun to see, and you’re going to see over the next couple months the oil prices, gas prices — prices of gas pump come down.” (President Biden, “Remarks by President Biden at the Summit for Democracy Closing Session,” 12/10/2021)

May marked the Thirteenth consecutive month in which inflation rose at least 5 percent. (Bureau of Labor Statistics, Accessed 6/10/2022)

- May also marked the Sixth consecutive month in which inflation rose at least 7 percent. (Bureau of Labor Statistics, Accessed 6/10/2022)

Over The Past Year, Prices For Goods And Services Essential To Everyday Life Have Skyrocketed, With Grocery Prices Increasing The Most Since The 1970s

(U.S. Senate Finance Committee Ranking Member, Press Release, 6/10/2022)

The price of all items increased 8.6% year-on-year. (Bureau of Labor Statistics, Accessed 6/10/2022)

Food prices increased 10.1% year-on-year, the largest increase since 1981. (Bureau of Labor Statistics, Accessed 6/10/2022)

Food at home (grocery) prices increased 11.9% year-on-year, the largest increase since 1979. (Bureau of Labor Statistics, Accessed 6/10/2022)

Prices for food away from home increased 7.4% year-on-year, the largest increase since 1981. (Bureau of Labor Statistics, Accessed 6/10/2022)

Prices for full service meals and snacks (restaurants) increased 9% year-on-year, the largest increase EVER. (Bureau of Labor Statistics, Accessed 6/10/2022)

Electricity prices increased 12% year-on-year, the largest increase since 2006. (Bureau of Labor Statistics, Accessed 6/10/2022)

Gasoline prices have increased 48.7% year-on-year. (Bureau of Labor Statistics, Accessed 6/10/2022)

Fuel oil prices increased 106.7% year-on-year, the largest increase ever. (Bureau of Labor Statistics, Accessed 6/10/2022)

Prices for housing increased 6.9% year-on-year, the largest increase since 1982. (Bureau of Labor Statistics, Accessed 6/10/2022)

Prices for rent of primary residence increased 5.2% year-on-year, the largest increase since 1987. (Bureau of Labor Statistics, Accessed 6/10/2022)

Airline fares increased 37.8% year-on-year, the largest increase since 1980. (Bureau of Labor Statistics, Accessed 6/10/2022)

Prices for services increased 5.7% year-on-year, the largest increase 1991. (Bureau of Labor Statistics, Accessed 6/10/2022)

Meanwhile, Gas Prices Nationwide Have Exceeded $5 A Gallon: ‘One Of The Most Visceral Ways People Feel Inflation In Their Daily Lives’

“The average price of a gallon of gas nationwide exceeded $5 on Thursday, crossing the milestone after a rapid rise over the past month that has alarmed public officials and strained the budgets of everyday Americans, according to GasBuddy.” (“Gas Prices Hit $5 National Average After Rapid Rise,” ABC News, 6/9/2022)

“The stunning run-up in gas prices has become one of the most visceral ways people feel inflation in their daily lives.” (“Inflation Hit New Peak May, Amid High Gas Prices,” The Washington Post, 6/10/2022)

- “For everyday drivers, gas prices, in particular, are acting as a kind of billboard for the rising cost of living. ‘We’re in uncharted territory,’ said Patrick De Haan, head of petroleum analysis at GasBuddy. He added that ‘it’s not something that’s going to turn around anytime soon, I’m afraid.’” (“Inflation Hit New Peak May, Amid High Gas Prices,” The Washington Post, 6/10/2022)

Compounding The Problem, Americans Are Now Losing Even More Of Their Paychecks To Inflation, With Year-On-Year Real Average Weekly Earnings Decreasing 3.9%

“Real average hourly earnings decreased 3.0 percent, seasonally adjusted, from May 2021 to May 2022. The change in real average hourly earnings combined with a decrease of 0.9 percent in the average workweek resulted in a 3.9-percent decrease in real average weekly earnings over this period.” (Bureau of Labor Statistics, Press Release, Accessed 6/10/2022)

‘Most Americans Expect Inflation To Get Worse In The Next Year’ And Many Are Struggling To Keep Up With Soaring Prices For Gas, Food, And Housing

“Most Americans expect inflation to get worse in the next year and are adjusting their spending habits in response to rising prices, according to a poll conducted by The Washington Post and George Mason University’s Schar School of Policy and Government. Inflation, which is near 40-year highs, has lifted the cost of just about everything, including essentials such as gas, groceries and housing. Overall prices are up 8.3 percent in the past year.” (“Most Americans Expect Inflation To Get Worse, Post-Schar School Poll Finds,” The Washington Post, 6/09/2022)

- “After months of dismissing price hikes as a short-term shock, the Federal Reserve recently began raising interest rates in hopes of cooling the economy enough to temper inflation. Even so, two-thirds of Americans (66 percent) expect inflation to get worse in the coming year …” (“Most Americans Expect Inflation To Get Worse, Post-Schar School Poll Finds,” The Washington Post, 6/09/2022)

“Families are feeling the pinch. Nearly 9 in 10 Americans say they’ve started bargain-hunting for cheaper products, and about three-quarters are cutting back on restaurants and entertainment, or putting off planned purchases, according to the Post-Schar poll conducted in late April and early May.” (“Most Americans Expect Inflation To Get Worse, Post-Schar School Poll Finds,” The Washington Post, 6/09/2022)

- “After more than a year of steadily rising prices, many Americans are beginning to rethink their spending habits to account for inflation. About 6 in 10 people say they are driving less, minimizing their use of electricity and saving less, while about half say they are trying to buy products before prices go up, the poll finds. And just under 3 in 10 say they have taken on a second job or worked more hours as a result of inflation.” (“Most Americans Expect Inflation To Get Worse, Post-Schar School Poll Finds,” The Washington Post, 6/09/2022)

“More than a third of Americans say recent price increases have been a major financial stress on their households, with concerns peaking among lower-income households: A 54 percent majority of people with household incomes below $50,000 say rising prices are a ‘major financial stress,’ compared with 31 percent of those with incomes between $50,000 and $100,000 and 17 percent of those with incomes of $100,000 or more.” (“Most Americans Expect Inflation To Get Worse, Post-Schar School Poll Finds,” The Washington Post, 6/09/2022)

“Housing — which takes up the biggest chunk of most household budgets — has been a particular source of strain for many families. Home prices have risen 21 percent in the past year, according to the S&P CoreLogic Case-Shiller index, while asking rents are up 15 percent nationwide, Redfin data shows. About 1 in 4 Americans in the Post-Schar School poll say it would be easy to afford to rent a home in their current neighborhood if they had to move. But a 74 percent majority say it would be either “somewhat difficult” or ‘very difficult’ to relocate in their neighborhoods. Meanwhile, nearly half of renters report major financial stress from inflation …” (“Most Americans Expect Inflation To Get Worse, Post-Schar School Poll Finds,” The Washington Post, 6/09/2022)

“Gas prices — which are at record highs near $5 a gallon — are another source of stress. Most drivers — 64 percent of them — are making fewer trips for groceries to save gas, the poll finds, while 34 percent report driving slower and a little more than 2 in 10 have carpooled or worked from home because of gas prices. Meanwhile, more than 4 in 10 drivers say they have only partially filled their car’s gas tank, a figure that rises to 61 percent of drivers with incomes below $50,000, according to the poll.” (“Most Americans Expect Inflation To Get Worse, Post-Schar School Poll Finds,” The Washington Post, 6/09/2022)

‘We’re Cutting Back On Everything — And I Mean Everything,’ ‘I’m Getting Ready To Pay Rent And It’s Going To Take Every Single Dime I’ve Made’

“‘We’re cutting back on everything — and I mean everything,’ said Bethany Davis, who lives with her boyfriend in Barbourville, Ky. ‘Gas, meat, bread, it’s all expensive as hell. One moment you think you can afford to buy something, then you go to the store and it’s like, “Nope, can’t get that anymore either.”’” (“Most Americans Expect Inflation To Get Worse, Post-Schar School Poll Finds,” The Washington Post, 6/09/2022)

- “Davis says gas has become such a burden that she and her boyfriend recently filled up a few extra plastic jugs with fuel when gas prices temporarily dipped below $4.50 a gallon. She and her boyfriend both work at Dollar General and bring home a combined $300 a week, $80 of which goes toward gas for their old pickup truck. High gas prices, she said, are not only cutting into her budget but are also limiting employment options in her small town. The best-paying jobs are at factories on the outskirts of town, about 50 miles away. Davis’s boyfriend recently quit his $10-an-hour job at a cookie factory after the 80-minute daily commute became untenable. His Dollar General job is closer to home but pays just $9.25 an hour. ‘When you live in the middle of nowhere and gas prices keep going up, it affects everything,’ Davis said. ‘The struggle just keeps getting harder.’” (“Most Americans Expect Inflation To Get Worse, Post-Schar School Poll Finds,” The Washington Post, 6/09/2022)

“Tosha Jankosky pays $1,356 a month for a two-bedroom apartment she shares with her teenage sons in Noblesville, Ind. The 41-year-old office manager makes $23 an hour — the best wages of her career — but says she still feels like she is financially losing ground. She recently dropped her cable subscription, is cutting back on groceries and has put off buying furniture such as bed frames and a sofa. Still, she says, it’s becoming increasingly difficult to afford basic expenses. ‘I should be able to live on my own,’ she said. But ‘I’m getting ready to pay rent and it’s going to take every single dime I’ve made.’” (“Most Americans Expect Inflation To Get Worse, Post-Schar School Poll Finds,” The Washington Post, 6/09/2022)

Unsurprisingly U.S. Consumer Sentiment Fell To Its Lowest Level On Record And Just 13% Of Respondents Expect Their Incomes To Rise More Than Inflation

“US consumer sentiment plunged in early June to the lowest on record as soaring inflation continued to batter household finances. The University of Michigan’s preliminary June sentiment index fell to 50.2, from 58.4 in May, data released Friday showed. The figure was weaker than all estimates in a Bloomberg survey of economists which had a median forecast of 58.1. Inflation expectations, which the Federal Reserve watches closely, also moved higher early this month and 46% of respondents attributed their negative views to persistent price pressures. Just 13% expect their incomes to rise more than inflation, the lowest share in almost a decade.” (“US Consumer Sentiment Slumps to Record Low on Rapid Inflation,” Bloomberg, 6/10/2022)

Senate Republicans: ‘Inflation Remains Painfully High, Gas Prices Have Been Setting All-Time Highs And Families Are Choosing To Cut Everyday Expenses To Make Ends Meet,’ ‘The American People Are Getting A De Facto Pay Cut Because Of Inflation’

SEN. MIKE CRAPO (R-ID), Senate Finance Committee Ranking Member: “Inflation remains painfully high, gas prices have been setting all-time highs and families are choosing to cut everyday expenses to make ends meet. The nonpartisan Congressional Budget Office says rampant inflation and rising interest rates will continue to fuel deficits and crowd out other fiscal priorities. In the face of growing risks of recession and stagflation, notions of increasing taxes or massive new spending bills must be rejected.” (U.S. Senate Finance Committee Ranking Member, Press Release, 6/10/2022)

SEN. CHUCK GRASSLEY (R-IA), Senate Finance Committee Member: “Iowans are paying the price for President Biden’s reckless policies, which have caused inflation to reach a 40-year high. It’s why concerns about soaring gas and grocery prices come up at every single one of my 99 county meetings. I’m glad Secretary Yellen indicated she opposes price controls and windfall profit taxes that far-left members of her party have advocated for. Such policies failed to address inflation in the 1970s and led to rampant shortages. However, I’m disappointed that the Biden Administration continues to ignore the role excessive government spending played in fueling inflation.” (Sen. Grassley Press Release, 6/06/2022)

SEN. JOHN THUNE (R-SD), Senate Finance Committee Member: “The economic crisis American people are feeling right now is this extraordinarily high inflation rate, which, again, to the degree that there may have been jobs created and wage increases completely eaten up. I mean, the American people are getting a de facto pay cut because of inflation. … And I see no strategy out of the Administration to do anything to deal with rising gas prices. I think that there’s no question that the $2 trillion bill last year overheated the economy, and it’s why we have the mess that we have today.” (Sen. Thune, U.S. Senate Finance Committee Hearing, 6/07/2022)

SEN. STEVE DAINES (R-MT), Senate Finance Committee Member: “It’s truly remarkable what’s happening with the inflationary hurricane force winds are blowing today. It’s in the minds of the people that I serve every day. They see it at the gas pump, in the grocery store, they see fertilizer prices for our farmers. The Biden Administration has attributed this broad base rapid inflation that began last year to Putin. It’s been attributed to greed, exploitation, profiteering. The one thing we’ve not heard the Administration say is that there may have been a contributing factor with the $1.9 trillion spending package that was passed in March of 2021, by this Congress, that we were calling out the concerns of the inflationary pressures that it would create in the economy. Even former Obama Administration officials, we saw that with Larry Summers…warned this would spark inflation. He was exactly right.” (Sen. Daines, U.S. Senate Finance Committee Hearing, 6/07/2022)

SEN. JOHN BARRASSO (R-WY), Senate Finance Committee Member: “Inflation is at a 40-year high. It is impacting Americans with higher prices across the board. When President Biden took office, the price of a gallon of gas was $2.38. Now it is almost $5. This past Memorial Day was a very expensive for people to travel. In my home state of Wyoming in rural areas, people who volunteer to drive for ‘Meals on Wheels’ to deliver meals to shut-ins, have had to stop volunteering. Not because they don’t have the time or the commitment or the open heart, they don’t have the money for the gas. That is the number one issue affecting the American people.” (Sen. Barrasso, U.S. Senate Finance Committee Hearing, 6/07/2022)

###

SENATE REPUBLICAN COMMUNICATIONS CENTER

Related Issues: Inflation, Economy

Next Previous