Biden’s Irresponsible Budget Triples Down On Tax Hikes, Government Spending, And Debt

Following Two Years Of Out-Of-Control Democrat Spending, Tax Hikes, And Massive Deficits, President Biden Has Submitted A Budget Calling For Even More Taxing, Spending, And Red Ink That Would Balloon The Federal Government While Still Managing To Shortchange Defense And Border Security

JOE BIDEN: “My dad used to have an expression: ‘Don’t tell me what you value. Show me your budget, and I’ll tell you what you value.’” (Joe Biden, Remarks, 9/15/2008)

Senate Republicans: President Biden’s Budget Is ‘A Roadmap To Fiscal Ruin’ Stuffed With ‘Out-Of-Control Spending’ And ‘Instead Of Lowering Costs, The President Is Raising Taxes’

SEN. CHUCK GRASSLEY (R-IA), Senate Budget Committee Ranking Member: “President Biden’s FY2024 budget proposal is a roadmap to fiscal ruin. From its delayed rollout to its reckless taxes and out-of-control spending, this budget sends a clear message: President Biden doesn’t seem to give a rip about keeping his promises or securing the fiscal health of our nation.” (U.S. Senate Budget Committee Ranking Member, Press Release, 3/09/2023)

- SEN. GRASSLEY: “Even with near-record revenues, President Biden wants to raise taxes on every segment of America. Under his plan, the government’s bite out of the economy would be the largest since World War II. And despite all that, he’s somehow managed to continue adding to our national debt at a breakneck speed. It’s an unserious proposal, and will be treated as such by both parties in Congress.” (U.S. Senate Budget Committee Ranking Member, Press Release, 3/09/2023)

- SEN. GRASSLEY: “It’s past time President Biden gets serious about the fiscal challenges facing this country. That means actually engaging in talks about the debt limit and working with Congress to restore the budget process.” (U.S. Senate Budget Committee Ranking Member, Press Release, 3/09/2023)

SEN. JOHN BARRASSO (R-WY), Senate Republican Conference Chairman: “President Biden’s bloated budget reveals how out-of-touch he is with families in Wyoming and across the country. This president wants to raise taxes on hardworking families so he can fund his reckless, radical spending. Democrats’ reckless spending spree sent costs to a 40-year high. Record-high prices for gas and groceries have made it harder for families to keep up. Now, Joe Biden wants to spend even more. Instead of lowering costs, the president is raising taxes. Joe Biden is doubling down on the disastrous policies that are causing families to fall further and further behind. Joe Biden and the Democrats must stop wasting taxpayer dollars. President Biden’s bloated budget is dead on arrival.” (Sen. Barrasso, Press Release, 3/09/2023)

Budget Experts: ‘Spending In This Budget Is Excessive,’ ‘Higher Than Any Time During The Pandemic,’ ‘An Incoherent Collection Of Wishes That Don’t Add Up,’ ‘Dead On Arrival’

FORMER CBO DIRECTOR DOUG HOLTZ-EAKIN: “There’s no philosophy here — it’s just an incoherent collection of wishes that don’t add up, and it’s really quite frustrating. They couldn’t get it through when they controlled both houses; it’s dead on arrival now.” (“Biden Calls For Trillions In Tax Hikes And New Domestic Spending,” The Washington Post, 3/09/2023)

MAYA MacGUINEAS, President of the Committee for a Responsible Federal Budget: “Spending in this budget is excessive. At $6.9 trillion, spending next year would be higher than any time during the pandemic and about $2.5 trillion above the pre-pandemic level, representing growth of 55 percent. Despite the nearly $600 billion of prescription drug, defense, and other savings, the budget would spend about 25 percent of the economy per year – unheard of outside of a national emergency. There is nothing wrong with having a spending wish list, but we should wait to implement major new spending or tax cuts until the nation’s fiscal situation is stabilized – a plan that still requires $19 trillion of borrowing is nowhere near under control.” (“CRFB Reacts to the President’s FY 2024 Budget,” Committee for a Responsible Federal Budget, 3/09/2023)

Biden’s Budget Is So Outrageous, Even Media Reports Can See It Clearly: ‘Trillions In Tax Hikes And New Domestic Spending,’ ‘A Campaign Pitch’ With ‘No Chance Of Becoming Reality’

THE WASHINGTON POST: “Biden calls for trillions in tax hikes and new domestic spending” (The Washington Post, 3/09/2023)

USA TODAY: “White House unveiled Biden's dead-on-arrival budget boosting taxes …” (USA Today Politics, @usatodayDC, Twitter, 3/09/2023)

THE NEW YORK TIMES: “Biden’s $6.8 Trillion Budget Doubles Down on the Power of Government” (The New York Times, 3/09/2023)

- “The president’s full proposal has no chance of becoming reality …” (“Here’s What To Know About President Biden’s Budget Plan,” The New York Times, 3/09/2023)

POLITICO: “The government funding proposal, unveiled Thursday by the White House and which has no chance of passing Congress, marks … a campaign pitch …” (Politico, 3/09/2023)

Biden’s Budget Calls For Nearly $5 Trillion In Tax Increases On Americans

“The budget contains some $5 trillion in proposed tax increases …” (“Here’s What To Know About President Biden’s Budget Plan,” The New York Times, 3/09/2023)

- “As he has before, Mr. Biden proposed raising the top individual tax rate to 39.6% from 37%, raising the corporate tax rate to 28% from 21%, taxing top earners’ capital gains at higher rates and increasing taxes on U.S. companies’ foreign profits to 21% from 10.5%.... He would raise existing taxes on wages, self-employment income and investments to 5% from 3.8% above $400,000 in income and expand those taxes to cover active business income.” (“What’s in Biden’s 2024 Budget Request,” The Wall Street Journal, 3/09/2023)

SEN. MIKE CRAPO (R-ID), Senate Finance Committee Ranking Member: “The President’s budget makes clear the Administration has not learned from its mistakes that have led to two years of record-high inflation and excessive deficit spending. Instead, this Administration is doubling down with more of the same. ... Despite recently passing nearly $500 billion in additional taxes on America’s job creators, the White House wants to go further, continuing to rehash tax hike proposals that even the prior Democrat-controlled Congress would not support. Revenues are not the problem; Washington’s insatiable appetite for unfettered spending is the problem. The spending binge must stop. As hardworking Americans and job creators continue to face elevated inflation and supply-chain challenges, it is critical that our tax system promotes American jobs, manufacturing and higher wages for hardworking families.” (U.S. Senate Finance Committee Ranking Member, Press Release, 3/09/2023)

SENATE FINANCE COMMITTEE REPUBLICANS: “The budget request includes $4.7 trillion in new or increased taxes over the next decade.

- “A tax on individuals across income levels: The President’s budget calls for hiking the individual federal income tax rate up to 39.6 percent from 37 percent, not including surtaxes. In addition to raising the rate, the proposal also lowers tax brackets by hundreds of thousands of dollars, thereby pushing tax increases on even more hardworking Americans.”

- “A tax on Main Street: The President’s budget calls for a 5 percent surtax on gross income above $400,000, and for extending the surtax to business income and investment income alike. Hardworking entrepreneurs could face federal taxes of roughly 42 percent, and nearly 45 percent when combined with the President’s individual rate increase proposal. Add in state and local taxes, and many--particularly in high-tax states—would see their tax rate soar well above 50 percent, regardless of whether they reinvest money into their businesses.”

- “A tax on America’s job creators: The President’s budget calls for increasing the income tax rate on incorporated businesses to 28 percent. According to the nonpartisan Joint Committee on Taxation, the effects of hiking this tax would primarily be borne by those making less than $500,000 per year. A separate study shows consumers shoulder more than 30 percent of any comparable tax increase. When combined with state and local taxes, many companies would face an income tax rate far higher than China’s (25 percent) and Europe (average 21.7 percent).”

- “A tax that gives China the upper hand: Despite negotiating a 15 percent global minimum tax rate for the rest of the world, the President’s budget calls for hiking the U.S. global minimum tax rate to 21 percent, giving our biggest foreign competitors—like China—the upper hand.”

- “A tax on savings and investment: The President’s budget calls for quadrupling the stock buyback excise tax, harming Americans who save, invest, or participate in retirement plans. Imposing an excise tax on savings and investment artificially skews how a business decides to best use its funds.”

- “A tax on entrepreneurship and property: The President’s budget calls for implementing a new and complicated minimum tax on some property owners, specifically on the unrealized increase in the value of their property. This national property tax would discourage innovation and entrepreneurship, create additional difficulty for taxpayers and the overwhelmed Internal Revenue Service, and raise significant Constitutional issues.” (U.S. Senate Finance Committee Ranking Member, Press Release, 3/09/2023)

Biden’s budget also proposes nearly $40 billion in new energy taxes, on top of the energy taxes Democrats passed in their partisan taxing and spending spree last year, all of which will raise energy prices even further for American families. (Budget of the U.S. Government, Fiscal Year 2024, pp. 155-156, 3/09/2023)

SENATE BUDGET COMMITTEE REPUBLICANS: “The budget request focuses on tax hikes that will hit millions of hardworking Americans making under $400,000 and hurt the economy…. By the end of the budget window, taxes as a share of the economy reach levels only previously seen during World War II.” (U.S. Senate Budget Committee Ranking Member, Press Release, 3/09/2023)

The Biden Budget Would Supersize Federal Spending For ‘A Generational Expansion Of Government,’ Exceeding Pandemic Spending Levels And ‘Unheard Of Outside Of A National Emergency’

“The White House’s spending blueprint envisions a much more expansive role for the federal government overall, aiming for close to $10 trillion in annual spending by 2033 — up from roughly $6.3 trillion currently, and about $6.9 trillion in the next fiscal year …” (“Biden Calls For Trillions In Tax Hikes And New Domestic Spending,” The Washington Post, 3/09/2023)

- “The White House budget calls for more than $1 trillion in new spending on programs such as Medicaid, child care, prekindergarten, public housing and free community college.” (“Biden Calls For Trillions In Tax Hikes And New Domestic Spending,” The Washington Post, 3/09/2023)

- “The budget suggests Biden’s initial ambitions to pass a generational expansion of government — similar to that of Franklin Delano Roosevelt’s New Deal or Lyndon Johnson’s Great Society — could return as a key rallying cry for the party in 2024.” (“Biden Calls For Trillions In Tax Hikes And New Domestic Spending,” The Washington Post, 3/09/2023)

MAYA MacGUINEAS: “At $6.9 trillion, spending next year would be higher than any time during the pandemic and about $2.5 trillion above the pre-pandemic level, representing growth of 55 percent. Despite the nearly $600 billion of prescription drug, defense, and other savings, the budget would spend about 25 percent of the economy per year – unheard of outside of a national emergency.” (“CRFB Reacts to the President’s FY 2024 Budget,” Committee for a Responsible Federal Budget, 3/09/2023)

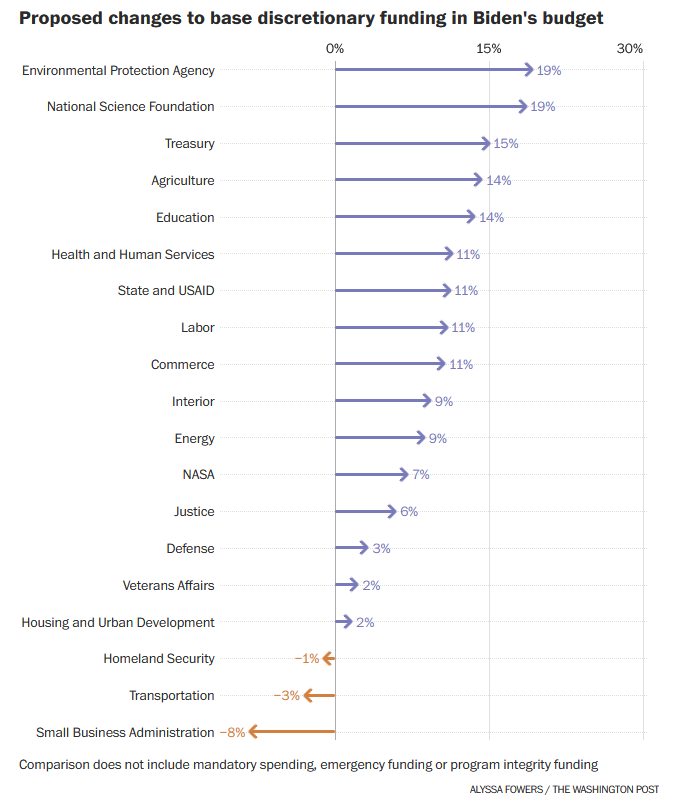

Biden’s Budget Would Massively Boost Spending On Agencies Like The EPA, NSF, IRS, And Labor Department, While Incredibly Cutting Funding For Homeland Security

(The Washington Post, 3/09/2023)

Biden’s Budget Would Increase Funding For The IRS by 15%, 5 Times The Percentage He Wants For Defense, On Top Of The $80 Billion Democrats Showered The Agency With Last Year

“President Joe Biden’s fiscal 2024 budget request includes a 15 percent increase to the IRS’ annual funding … The budget released Thursday seeks $14.1 billion for the IRS in 2024, a $1.8 billion increase over the enacted funding levels for 2023.” (“Biden Seeks Double-Digit Increase To IRS Budget, Targeting Tax Gap,” Politico Pro, 3/09/2023)

- “Couple IRS notes from the budget. Administration is seeking a 15% increase in the base budget for the agency, on top of the $80 billion. And it's also seeking >$14B a year in mandatory funding for 2032 and 2033 after the $80 billion runs out.” (The Wall Street Journal’s Richard Rubin, @RichardRubinDC, Twitter, 3/09/2023)

Biden’s Budget Would Drown The United States Beneath A Tidal Wave Of Red Ink, With Over $17 Trillion In Deficit Spending

“Estimated Biden budget deficits:

2024 - $1.846 trillion

2025 - $1.671 trillion

2026 - $1.521 trillion

2027 - $1.509 trillion

2028 - $1.604 trillion

2029 - $1.536 trillion

2030 - $1.686 trillion

2031 - $1.776 trillion

2032 - $1.871 trillion

2033 - $2.035 trillion

[Total:] $17.054 trillion” (Jamie Dupree, @jamiedupree, Twitter, 3/09/2023)

SENATE BUDGET COMMITTEE REPUBLICANS: “The President’s own budget proposes $17.1 trillion in cumulative deficits over the next ten years, with annual deficits reaching $2 trillion by the end of the budget window.” (U.S. Senate Budget Committee Ranking Member, Press Release, 3/09/2023)

- “The Biden Budget would increase debt held by the public from $25.9 trillion in 2023 to $43.6 trillion by 2033. Gross debt rises from $32.7 trillion at the close of this year to $50.7 trillion by 2033.” (U.S. Senate Budget Committee Ranking Member, Press Release, 3/09/2023)

- “Under the Biden Budget, debt held by the public surpasses the previous record as a share of GDP (106.1 percent) set in the wake of World War II in 2027 (106.3 percent). By the end of the budget, public debt as a share of the economy hits 109.8 percent.” (U.S. Senate Budget Committee Ranking Member, Press Release, 3/09/2023)

- “The Biden Administration’s reckless borrowing causes interest costs to continue to mount, going from $661 billion in 2023 to $1.3 trillion in 2033. Over the 2024-2033 window, interest costs will total a staggering $10.2 trillion.” (U.S. Senate Budget Committee Ranking Member, Press Release, 3/09/2023)

The Massive Debt And Deficit Increases Biden Proposes Once Again Make A Laughingstock Of His Claims To Fiscal Responsibility

“Biden frequently takes credit for the deficit declining between 2021 and 2022, although the expiration of his $1.9 trillion economic stimulus plan was largely responsible for the decline. An increase in the deficit this year and the next would sharply undercut the president’s promises.” (“Biden Calls For Trillions In Tax Hikes And New Domestic Spending,” The Washington Post, 3/09/2023)

- SENATE BUDGET COMMITTEE REPUBLICANS: “Despite the Administration’s delusional claims of reducing the deficit, the nonpartisan Congressional Budget Office projects deficits between 2021 and 2031 will be $6 trillion higher than was projected when Biden took office.” (U.S. Senate Budget Committee Ranking Member, Press Release, 3/09/2023)

Yet Again, Biden Would Shortchange America’s Military, With Defense Funding Failing To Keep Pace With Inflation

Biden’s budget proposal would increase spending for the Defense Department by a smaller percentage than increases for the National Science Foundation, the Labor Department, the Commerce Department, and the IRS. (The Washington Post, 3/09/2023)

SENATE BUDGET COMMITTEE REPUBLICANS: “Ignoring the reality of growing worldwide threats, the budget fails to adequately fund defense. The Biden Budget proposes a minimal increase for defense in 2024, followed by funding levels that fail to keep up with inflation.” (U.S. Senate Budget Committee Ranking Member, Press Release, 3/09/2023)

SEN. ROGER WICKER (R-MS), Senate Armed Services Committee Ranking Member: “The President’s defense budget is woefully inadequate and disappointing. It does not even resource his own National Defense Strategy to protect our country from growing threats around the world. This defense budget is a serious indication of President Biden’s failure to prioritize national security.” (Sen. Wicker, Press Release, 3/9/2023)

- SENATE ARMED SERVICES COMMITTEE REPUBLICANS: “Accounting for inflation, the President has now asked Congress to cut military spending for three years in a row, despite a worsening threat environment. Wicker, along with overwhelming bipartisan majorities in Congress, has voted twice now to override the President’s defense budget and align it with the United States’ national strategy.” (Sen. Wicker, Press Release, 3/9/2023)

In The Midst Of A Crisis At The Southern U.S. Border, Biden’s Budget Would Shockingly Cut Funding For The Department Of Homeland Security

“The Budget requests $60.4 billion in discretionary budget authority for 2024, a $0.6 billion or one-percent decrease from the 2023 enacted level.” (Budget of the U.S. Government, Fiscal Year 2024, p. 83, 3/09/2023)

SEN. KATIE BRITT (R-AL): “The Biden Admin hasn’t taken border security seriously its entire tenure. Today’s disastrous Department of Homeland Security budget proposal only cements the President’s complete disinterest in solving the unprecedented national security and humanitarian crisis at the border.” (Sen. Britt, @SenKatieBritt, Twitter, 3/09/2023)

###

SENATE REPUBLICAN COMMUNICATIONS CENTER

Related Issues: America's Military, Budget, Debt And Deficits, Homeland Security, Democrats' Reckless Taxing And Spending Spree, Immigration, Economy, IRS, Taxes, Energy

Next Previous