American Families Who Have Suffered Two Years Of ‘Bidenomics’ Price Increases Reject Democrats’ Rosy Economic Spin

As Year-Over-Year Inflation Increased Again Last Month, Americans Paying Ever More To Feed Their Families, Fill Up Their Cars, And Shop For School Supplies Are Unsurprisingly Pessimistic About The Economy And Overwhelmingly Disapprove Of Costly ‘Bidenomics’

After Paying For Two Years Of Joe Biden’s Inflation, Americans Are Unhappy About The Economy And Disdainful Of Biden’s Economic Policies

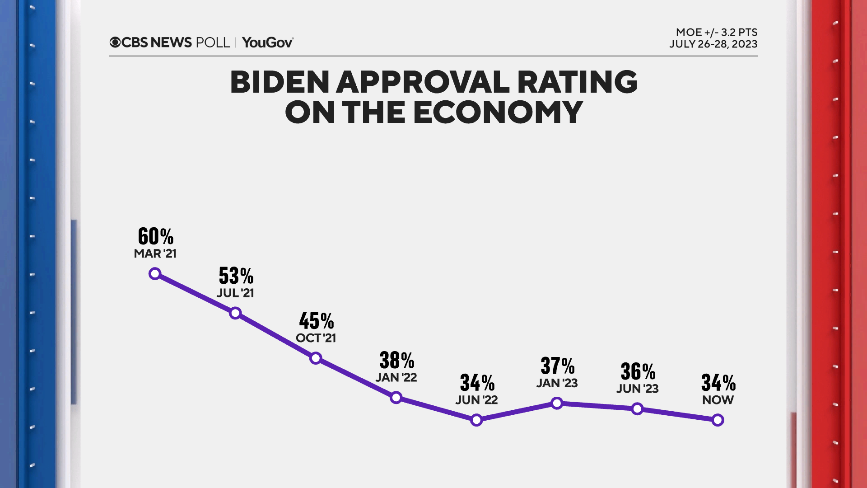

(“The Economy's Long, Hot, And Uncertain Summer,” CBS News, 7/30/2023)

“Americans are hot, and very much still bothered by high prices …” (“The Economy's Long, Hot, And Uncertain Summer,” CBS News, 7/30/2023)

“[T]he American public remains negative about the state of the nation’s economy, with 51% saying they think the economy is still in a downturn and getting worse, according to a new CNN poll.” (“CNN Poll: Half Of Americans Think The Economy Is Getting Worse, Despite Months Of Stronger Economic News,” CNN, 8/03/2023)

“[President Joe Biden’s] approval drops to 37% when Americans assess his handling of the economy and further still to 30% for his handling of inflation. Among political independents, a scant 26% approve of his handling of inflation.” (“CNN Poll: Half Of Americans Think The Economy Is Getting Worse, Despite Months Of Stronger Economic News,” CNN, 8/03/2023)

“Many Americans who voted for U.S. President Joe Biden in 2020 say they believe the economy has faired poorly under his stewardship and that they might not vote for him in the 2024 election, according to a new Reuters/Ipsos poll.” (“Economic Worries Could Cost Biden Some Of His 2020 Supporters -Reuters/Ipsos,” Reuters, 8/04/2023)

“[T]his economic mood keeps weighing on the president's overall numbers. His handling of the economy is as low as it's been, along with his overall approval rating too, which has been hovering in the low-40s range for more than a year, now down to 40%.” (“The Economy's Long, Hot, And Uncertain Summer,” CBS News, 7/30/2023)

‘Perceptions Of The Economy Remain Bleak’

“Perceptions of the economy remain bleak. Overall, just 25% say economic conditions are at least somewhat good. That includes a scant 3% saying things are ‘very good,’ a figure that has held under 5% for nearly two years.” (“CNN Poll: Half Of Americans Think The Economy Is Getting Worse, Despite Months Of Stronger Economic News,” CNN, 8/03/2023)

“About half (51%) say the nation’s economy is still in a downturn and conditions are continuing to worsen, while only 20% say they see the economy as improving.” (“CNN Poll: Half Of Americans Think The Economy Is Getting Worse, Despite Months Of Stronger Economic News,” CNN, 8/03/2023)

“Forty-two percent of Biden's 2020 voters in the poll said the economy was ‘worse’ than it was in 2020, compared to 33% who said it was ‘better’ and 24% who said it was ‘about the same.’” (“Economic Worries Could Cost Biden Some Of His 2020 Supporters -Reuters/Ipsos,” Reuters, 8/04/2023)

“[M]ost describe the economy as ‘uncertain,’ along with calling it bad, and ‘struggling’ but not improved. So, there's plenty of lagging skepticism hanging over the public mind after the turmoil of recent years and months of chatter about a potential recession. Almost no one is calling things ‘stable.’ And that's the case despite relatively good feelings about the job market and job security. It's not just whether one has a job, but what your wages can buy you. Most of those working say their pay is not keeping pace with rising prices.” (“The Economy's Long, Hot, And Uncertain Summer,” CBS News, 7/30/2023)

‘Prices Are The No. 1 Reason People Give When Asked Why They Call The Economy Bad’

“Prices are the No. 1 reason people give when asked why they call the economy bad and the top reason given when they describe their personal financial situation as bad.” (“The Economy's Long, Hot, And Uncertain Summer,” CBS News, 7/30/2023)

“When asked which issue is the most important facing the country today, economic concerns continue to dominate, with 44% citing an economy-related issue such as the cost of living or inflation (19%); the economy generally (16%); or poverty, finances and money (3%). No other single issue was named by more than 10% of Americans.” (“CNN Poll: Half Of Americans Think The Economy Is Getting Worse, Despite Months Of Stronger Economic News,” CNN, 8/03/2023)

“…about seven in 10 say that they have changed the groceries they buy in order to stay within budget (71% now, same as in December) and have cut back on spending on extras and entertainment in order to afford necessities (70% now, 71% in December).” (“CNN Poll: Half Of Americans Think The Economy Is Getting Worse, Despite Months Of Stronger Economic News,” CNN, 8/03/2023)

Americans Aren’t Buying The White House’s Insulting Spin About ‘Bidenomics’

“President Joe Biden is risking a lot on ‘Bidenomics.’ But, about two months in, his efforts to sell his sweeping economic agenda don’t appear to be working.” (“The White House Plays It Cool As ‘Bidenomics’ Struggles To Catch On,” Politico, 8/07/2023)

- “Independent polls show that large majorities of the country do not believe that the president’s economic policies have set the country in the right direction.” (“Biden Expresses Confidence on the Economy. Voters May Be Skeptical.” The New York Times, 6/26/2023)

- “Most don't think the Biden administration is lowering inflation...” (“The Economy's Long, Hot, And Uncertain Summer,” CBS News, 7/30/2023)

“Most tie both the U.S. economy and their own personal finances (whether bad or good) at least in part to President Biden's policies — an important measure of both macro and micro connection — and also to that very immediate measure of prices.” (“The Economy's Long, Hot, And Uncertain Summer,” CBS News, 7/30/2023)

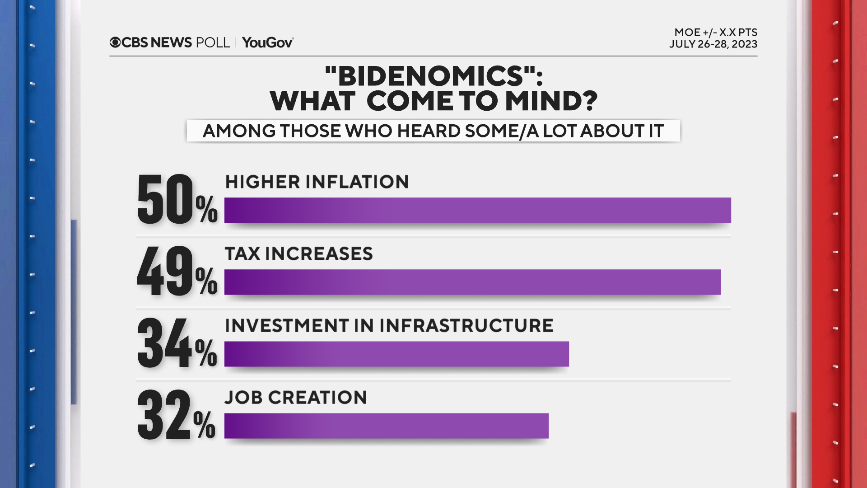

In Fact, Most Americans Who Are Familiar With ‘Bidenomics’ ‘Equate It With “Higher Inflation” And Even “Tax Increases”’

(“The Economy's Long, Hot, And Uncertain Summer,” CBS News, 7/30/2023)

“This also shows the challenge President Biden faces in his latest push to get the public to reconsider not just how they think of the economy, which few describe as ‘rebounding,’ but also the meaning of the phrase his administration has coined, ‘Bidenomics.’ It is not, as of yet, a widely known term by any means. The people who say they have heard something of the term skew Republican right now. So, to many of them, it looks more pejorative. Half say they equate it with ‘higher inflation’ and even ‘tax increases,’ by far the top two items chosen. That said, most independents also mention those two items first.” (“The Economy's Long, Hot, And Uncertain Summer,” CBS News, 7/30/2023)

The Cumulative Effect Of Inflation Since President Biden Took Office Has Americans Paying Significantly Higher Prices For Food, Energy, Transportation, Housing, And More

Since President Biden took office, inflation has increased 16.9%. (Bureau of Labor Statistics, Accessed 8/10/2023)

- Grocery (food at home) prices have increased 20%. (Bureau of Labor Statistics, Accessed 8/10/2023)

- Food away from home prices have increased 18%. (Bureau of Labor Statistics, Accessed 8/10/2023)

- Energy prices have increased 38.8%. (Bureau of Labor Statistics, Accessed 8/10/2023)

- Prices for fuel oil have increased 49.6%. (Bureau of Labor Statistics, Accessed 8/10/2023)

- Gasoline (all types) prices have increased 53.4%. (Bureau of Labor Statistics, Accessed 8/10/2023)

- Natural gas prices have increased 23%. (Bureau of Labor Statistics, Accessed 8/10/2023)

- Electricity prices have increased 25.6%. (Bureau of Labor Statistics, Accessed 8/10/2023)

- Rental prices for a primary residence have increased 16%. (Bureau of Labor Statistics, Accessed 8/10/2023)

- Prices for used cars and trucks have increased 35%. (Bureau of Labor Statistics, Accessed 8/10/2023)

- Prices for new vehicles have increased 20%. (Bureau of Labor Statistics, Accessed 8/10/2023)

- Furniture prices have increased 18.4%. (Bureau of Labor Statistics, Accessed 8/10/2023)

- Apparel prices have increased 9.7%. (Bureau of Labor Statistics, Accessed 8/10/2023)

- Airline fares have increased 26%. (Bureau of Labor Statistics, Accessed 8/10/2023)

‘Even If Prices Aren’t Going Up As Rapidly As They Were, A Gallon Of Milk Or A New House Will Cost A Lot More Than It Did Not That Long Ago’

“But falling inflation doesn’t mean prices are returning to pre-pandemic levels. Policymakers are fighting to keep prices from rising too fast. But even if prices aren’t going up as rapidly as they were, a gallon of milk or a new house will cost a lot more than it did not that long ago.” (The Washington Post, 8/10/2023)

“Persistently high inflation — specifically grocery, gas and rent prices — has weighed on consumers for more than two years. Since March of last year, the Federal Reserve has raised interest rates 11 times to the highest level seen in 22 years in hopes of reining in inflation by tempering demand.” (“Consumer Prices Rose By 3.2% Annually In July, Picking Up For The First Time In 13 Months,” CNN, 8/10/2023)

Prices Rose Again In July, Still ‘Above The Federal Reserve’s 2% Inflation Target’

“Prices rose 3.2 percent in July from a year ago — outpacing June’s inflation rate of 3 percent … according to data released Thursday by the Bureau of Labor Statistics. On a monthly basis, prices ticked up 0.2 percent between June and July.” (“Progress On Inflation Stalled In July, As Prices Nudged Up,” The Washington Post, 8/10/2023)

- “The latest figure remained … above the Federal Reserve’s 2% inflation target.” (The Associated Press, 8/10/2023)

‘Food Prices Are Much Higher Than They Were A Year Ago, And Costs Have Been Climbing At A Faster Rate Than Normal’

“The cost of food rose 0.2 percent in July from the prior month, a slight increase from 0.1 percent in June, according to data released Thursday by the Bureau of Labor Statistics. Grocery prices rose 0.3 percent in July, up from June … The cost of eating at restaurants continued to rise, climbing 0.2 percent over the month, a slowdown from 0.4 percent in June…. Still, food prices are much higher than they were a year ago, and costs have been climbing at a faster rate than normal.” (The New York Times, 8/10/2023)

- “Over the past 12 months, food is still up 4.9%.” (The Associated Press, 8/10/2023)

‘Housing, Car Insurance, Education And Recreation All Got Costlier In July’

“Housing, car insurance, education and recreation all got costlier in July. ‘Core’ inflation — a closely watched measure that excludes food and energy costs, which tend to fluctuate more than other sectors — remains stubbornly elevated. In July, it rose 0.2 percent, keeping in line with the previous month’s growth.” (“Progress On Inflation Stalled In July, As Prices Nudged Up,” The Washington Post, 8/10/2023)

“[S]helter costs have continued to rise. In July, they contributed to more than 90 percent of the month’s overall inflation.” (“Progress On Inflation Stalled In July, As Prices Nudged Up,” The Washington Post, 8/10/2023)

“Used vehicle prices … remain 5.6% costlier, on average, than a year ago.” (The Associated Press, 8/10/2023)

“[A]uto insurance and repair costs have been surging. A key reason is that vehicle prices soared after parts shortages developed when the pandemic erupted; costlier cars are more expensive to fix and insure. Auto insurance prices have soared nearly 17% in the past year.” (The Associated Press, 8/08/2023)

‘Drivers Are In For Another Headache At The Pump As U.S. Gas Prices Continue To Rise’

“Drivers are in for another headache at the pump as U.S. gas prices continue to rise.” (The Associated Press, 8/02/2023)

“Some of the summer’s biggest swings have come from energy costs. Brent crude oil prices, for example, are up 17 percent since June, while average gas prices have risen 7 percent to $3.83 per gallon, AAA data shows.” (“Progress On Inflation Stalled In July, As Prices Nudged Up,” The Washington Post, 8/10/2023)

- According to the Energy Information Administration (EIA), the weekly national retail gasoline price on January 18, 2021 was $2.379 per gallon. (U.S. Energy Information Administration, 6/26/2023)

“Benchmark crude prices are up more than 18% over the past month, driving up the cost of American workers’ commutes, freight haulers’ trips to and from warehouses and the production of everything from plastics and fertilizers to clothing.” (“Rising Oil Prices Are Bad News for Drivers—and the Fed,” The Wall Street Journal, 8/07/2023)

“Over the past three months, wholesale diesel costs jumped 36%, jet fuel climbed almost 40% and gasoline rose 19%.” (“Rising Oil Prices Are Bad News for Drivers—and the Fed,” The Wall Street Journal, 8/07/2023)

‘You’re Paying For It At The Grocery Store, With The Cost Of Building Materials, Household Goods’

“‘You’re paying for it at the grocery store, with the cost of building materials, household goods,’ said Mike Kucharski, vice president of JKC Trucking, a 200-truck operation based in Illinois. ‘Everybody can feel the high costs.’ Diesel’s climb has been particularly costly for JKC during this summer’s heat waves, since the company’s refrigerated semitrailers need to burn more fuel to keep lettuce, melons and other produce cold in transit. The company updates its fuel surcharge for customers once a week, Kucharski said, but prices have risen so quickly in recent days that his company has had to eat some of the costs.” (“Rising Oil Prices Are Bad News for Drivers—and the Fed,” The Wall Street Journal, 8/07/2023)

‘Back-To-School Shopping To Cost Americans More Than Ever’

FOX BUSINESS: ‘Back-To-School Shopping To Cost Americans More Than Ever Amid Inflation Spike’ (“Back-To-School Shopping To Cost Americans More Than Ever Amid Inflation Spike,” Fox Business, 8/06/2023)

- “Inflation is hitting parents' pocketbooks hard, with back-to-school shopping forecast to cost American families the most ever amid higher prices for everything from calculators to crayons.” (“Back-To-School Shopping Could Cost Families A Record Amount This Year. Here's How To Save.” CBS News, 8/07/2023)

- “Higher prices and demand for electronics are taking a bigger bite out of consumer budgets — and driving record spending — according to the National Retail Federation's annual survey.” (“Back-To-School Shopping Hit By Inflation, Higher Prices,” Axios, 8/06/2023)

“Inflation will have a ‘very big’ impact on back-to-school shopping for 31% of parents and an ‘extremely big’ impact for 29%, according to a Crayola survey of 1,500-plus parents shared exclusively with Axios.” (“Back-To-School Shopping Hit By Inflation, Higher Prices,” Axios, 8/06/2023)

- “Families with children in elementary through high school plan to spend an average of $890.07 on back-to-school items about $25 more than last year's record, per NRF's survey of 7,843 consumers.” (“Back-To-School Shopping Hit By Inflation, Higher Prices,” Axios, 8/06/2023)

Price Increases For Classroom Essentials Are Outpacing Other Major Goods

“Prices for many classroom essentials have outpaced the 4% increase in other major goods, according to an analysis by Pattern. This is how much prices of back-to-school staples have increased compared to last year:

Graph Paper - 18%

Mechanical Pencils - 16%

Folders - 13%

Highlighters - 13%

Index Cards - 12%

Crayons - 12%

Composition Books - 9%

Rulers - 8%

Scientific Calculators - 6%” (“Back-To-School Shopping Could Cost Families A Record Amount This Year. Here's How To Save.” CBS News, 8/07/2023)

‘Americans’ Credit Card Debt Hits A Record $1 Trillion’ ‘As Stubborn Inflation Makes The Cost Of Everyday Necessities More Expensive’

“Americans are drowning in credit card debt as stubborn inflation makes the cost of everyday necessities more expensive.” (“Credit Card Debt Set To Hit $1T As Inflation Continues Squeezing Americans,” Fox Business, 8/07/2023)

- “[P]ersistently high inflation coupled with spiking interest rates have weighed down consumers …” (“Americans’ Credit Card Debt Hits A Record $1 Trillion,” CNN Business, 8/08/2023)

“Americans’ credit card debt levels have just notched a new, but undesirable, milestone: For the first time ever, they’ve surpassed $1 trillion, according to data released Tuesday by the Federal Reserve Bank of New York. During the second quarter, credit card balances shot up by $45 billion, or nearly 4.6%, to land at $1.03 trillion, according to the New York Fed’s latest Quarterly Report on Household Debt and Credit.” (“Americans’ Credit Card Debt Hits A Record $1 Trillion,” CNN Business, 8/08/2023)

- “Credit card balances have risen for five consecutive quarters, increasing at some of the largest rates in 20 years, an analysis of New York Fed data shows. ‘Unfortunately, it’s only going to go up from here,’ Matt Schulz, chief credit analyst for LendingTree, said in an interview with CNN ‘What’s driving it is inflation, higher interest rates and just generally how expensive life is in 2023.’” (“Americans’ Credit Card Debt Hits A Record $1 Trillion,” CNN Business, 8/08/2023)

- “The rise in credit card usage and debt is particularly concerning because interest rates are astronomically high right now. The average credit card annual percentage rate, or APR, hit a new record of 20.53% last week, according to a Bankrate database that goes back to 1985. The previous record was 19% in July 1991.” (“Credit Card Debt Set To Hit $1T As Inflation Continues Squeezing Americans,” Fox Business, 8/07/2023)

“‘Budgets are still very stretched and, for a lot of households, credit cards are filling the gap,’ said Greg McBride, Bankrate’s chief financial analyst. ‘People aren’t financing purchases at 20% because they have other options,’ he added. ‘They’re doing that because it’s their only option.’” (“61% Of Americans Say They Are Living Paycheck To Paycheck Even As Inflation Cools,” CNBC, 7/31/2023)

- “The inflation spike has created severe financial pressures for most U.S. households, which are forced to pay more for everyday necessities like food and rent. The burden is disproportionately borne by low-income Americans, whose already-stretched paychecks are heavily affected by price fluctuations.” (“Credit Card Debt Set To Hit $1T As Inflation Continues Squeezing Americans,” Fox Business, 8/07/2023)

- “Earlier Tuesday, Bank of America reported that more people were tapping their 401(k) accounts because of financial distress. The number of people who made a hardship withdrawal during the second quarter surged from the first three months of the year to 15,950, an increase of 36% from the second quarter of 2022.” (“Americans’ Credit Card Debt Hits A Record $1 Trillion,” CNN Business, 8/08/2023)

###

SENATE REPUBLICAN COMMUNICATIONS CENTER

Related Issues: Economy, Education, Energy, Inflation

Next Previous